Understand Danish Taxation and Health Care in 2025

Primary keyword: “Understand Danish Taxation and Health Care”

Quick-Read Takeaways

1 │ Why Taxes & Healthcare Are a Package Deal in Denmark

Denmark links its digital identity (CPR), tax administration (SKAT) and national health service. No CPR → no tax card → no salary and no yellow health card. Filing late or failing to insure yourself privately before CPR activation can trigger fines, back taxes and uncovered medical bills.

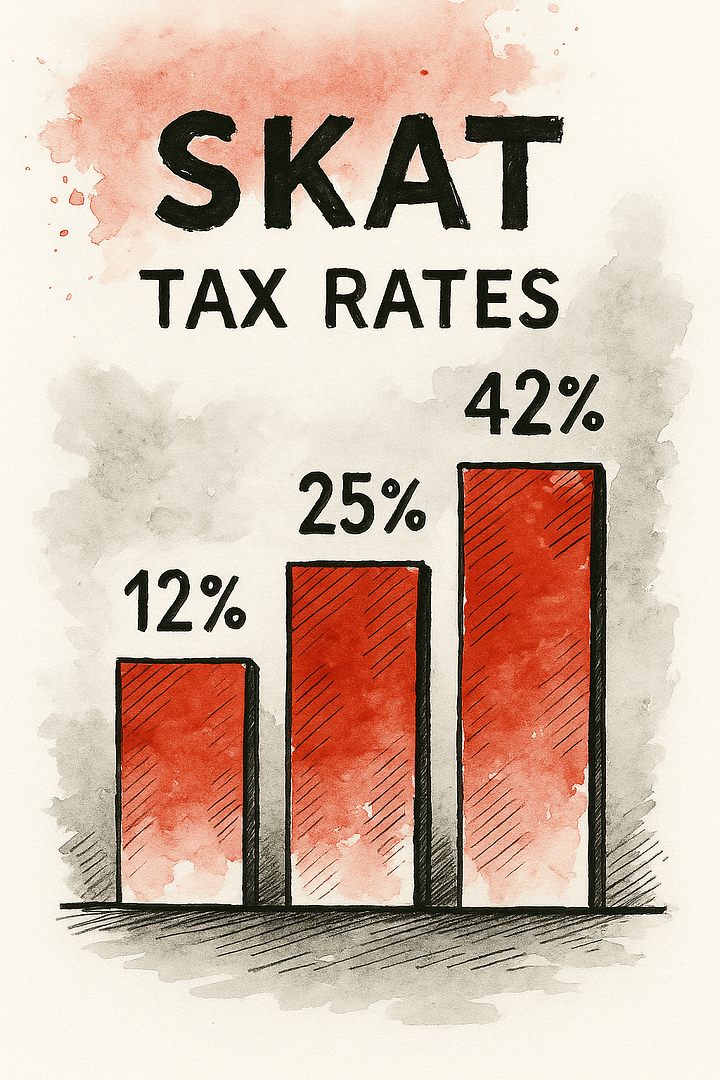

2 │ Danish Tax System Explained

2.1 Core Components

| Tax Element | 2025 Rate / Threshold | Notes |

|---|---|---|

| Labour Market Contribution (AM-bidrag) | 8 % | Charged on all earned income first |

| Municipal & Church Tax | 24-28 % average | Varies by kommune |

| State Tax – Bottom Bracket | 12.15 % | Charged on income above personal allowance |

| State Tax – Top Bracket | 15 % | Applies to income > DKK 552 500 (skat.dk | skat.dk) |

| Healthcare Tax | Abolished 2019 | Folded into other bands |

Effective rates typically land between 37 % and 42 % for mid-level earners; up to 55 % for top-bracket pay.

2.2 Special 32.84 % Expat Scheme (Forskerordningen)

Foreign researchers & highly-paid specialists (salary ≥ DKK 72 600/month in 2025) can elect a flat 27 % tax + 8 % AM for seven years—no deductions, but a huge saving compared to progressive rates. (Øresunddirekt.se, skatteinform.dk)

2.3 Getting Your First Tax Card

- Register address & obtain CPR.

- Create MitID or E-tax password.

- Log into skat.dk/TastSelv → “Apply for tax card”. Card is sent digitally to employer. (skat.dk | skat.dk, skat.dk | skat.dk)

Pro Tip: If you expect large relocation allowances, update your preliminary income assessment (forskudsopgørelse) to avoid under-withholding. (skat.dk | skat.dk)

3 │ Deductions & Allowances Newcomers Often Miss

- Personal allowance: DKK 50 400 (2025).

- Commuter deduction: Distance-based if you live > 12 km from work.

- Expat home leave deduction: Certain permits allow write-off of two annual trips home.

- Pension contributions: Foreign schemes can be deducted if approved by SKAT.

4 │ Late-Filing & Penalties

Missing the 1 May online tax return deadline triggers:

- Automatic DKK 800 fine (first month) + DKK 200/day up to 3 000.

- Interest on underpaid tax (currently 3.4 %).

5 │ Danish Health Care for Non-EU Residents

5.1 Eligibility Timeline

| Phase | Your Status | Coverage |

|---|---|---|

| 0-3 months | Valid entry visa/residence permit | No automatic cover. Must hold private insurance. (Relocate.me) |

| > 3 months & CPR issued | Registered resident | Full public healthcare: GP, hospitals, emergency care. (International.kk.dk, International.kk.dk) |

5.2 The Yellow Health Card

- Contains CPR, address, chosen general practitioner.

- Needed for all appointments and issuing MitID. (International.kk.dk)

5.3 What’s Free vs Paid

| Service | Cost to CPR Holder |

|---|---|

| GP consultation | Free |

| Hospital in-patient care | Free |

| Emergency services | Free |

| Dental (adults) | 40-60 % subsidised |

| Physiotherapy, psychologists | Part-subsidised with referral |

5.4 Changing GP or Insurance Group

After 12 months you may switch GP/insurance group for a DKK 40 fee. (International.kk.dk)

6 │ Private & Supplementary Insurance

- Basic private plan (~DKK 250/month) covers faster specialist access and dental.

- Travel & repatriation cover is essential until you hold a yellow card.

7 │ Tax-Health Intersections to Watch

- Salary sacrifice for health insurance is taxable benefit.

- Employer-paid private health plans are tax-exempt up to DKK 3 600/year.

- Healthcare reimbursements under the researcher scheme remain taxable income.

8 │ Compliance Checklist for Newcomers

- Register address + CPR within 5 days of move-in.

- Apply for tax card on skat.dk.

- Take out private health insurance until CPR active.

- Choose GP when ordering yellow card.

- Mark 1 May (tax return) & 15 March (preliminary income) in your calendar.

9 │ Frequently Asked Questions

Q 1. Can I keep paying tax in my home country?

Only if covered by a valid double-taxation treaty and usually limited to short-term postings; otherwise Danish tax residency starts after 6 months or with permanent home.

Q 2. Does the yellow card cover dental emergencies?

Partially—public subsidy covers check-ups but you pay most restorative work. Consider private insurance.

Q 3. How long does CPR + yellow card issuance take?

Typically 1–2 weeks after your Borgerservice appointment, but can be longer in Copenhagen peak season. (Copenhagen Expats)

References

- SKAT, “Get a tax card as a non-Danish employee,” 2025 (skat.dk | skat.dk)

- SKAT Form 04.063, “Apply for tax card & tax number,” 2025 (skat.dk | skat.dk)

- SKAT, “Tax Rates 2025,” 2025 (skat.dk | skat.dk)

- Øresunddirekt, “Researcher/Key-Employee Tax Scheme,” 2025 (Øresunddirekt.se)

- International.kk.dk, “Yellow Health Card,” 2025 (International.kk.dk)

- Relocate.me, “Healthcare in Denmark,” 2025 (Relocate.me)

- LifeInDenmark, “Purchase of healthcare services,” 2024 (Life in Denmark)

- International.kk.dk, “Change your health insurance group,” 2025 (International.kk.dk)

- SKAT, “Preliminary income assessment,” 2025 (skat.dk | skat.dk)

(Always confirm details with skat.dk and your local kommune, as thresholds and rules may change after publication.)